Game of thrones

Knight Frank

The client:

Knight Frank is a real estate consultancy with 500 offices across 57 territories.

The task:

On Saturday October 1st 2022, an ABC news reporter tweeted that a major international investment bank was “on the brink.”

It was enough to prompt many wealthy clients to begin pulling their funds out of Credit Suisse. The Zurich-based investment bank would collapse just five months later.

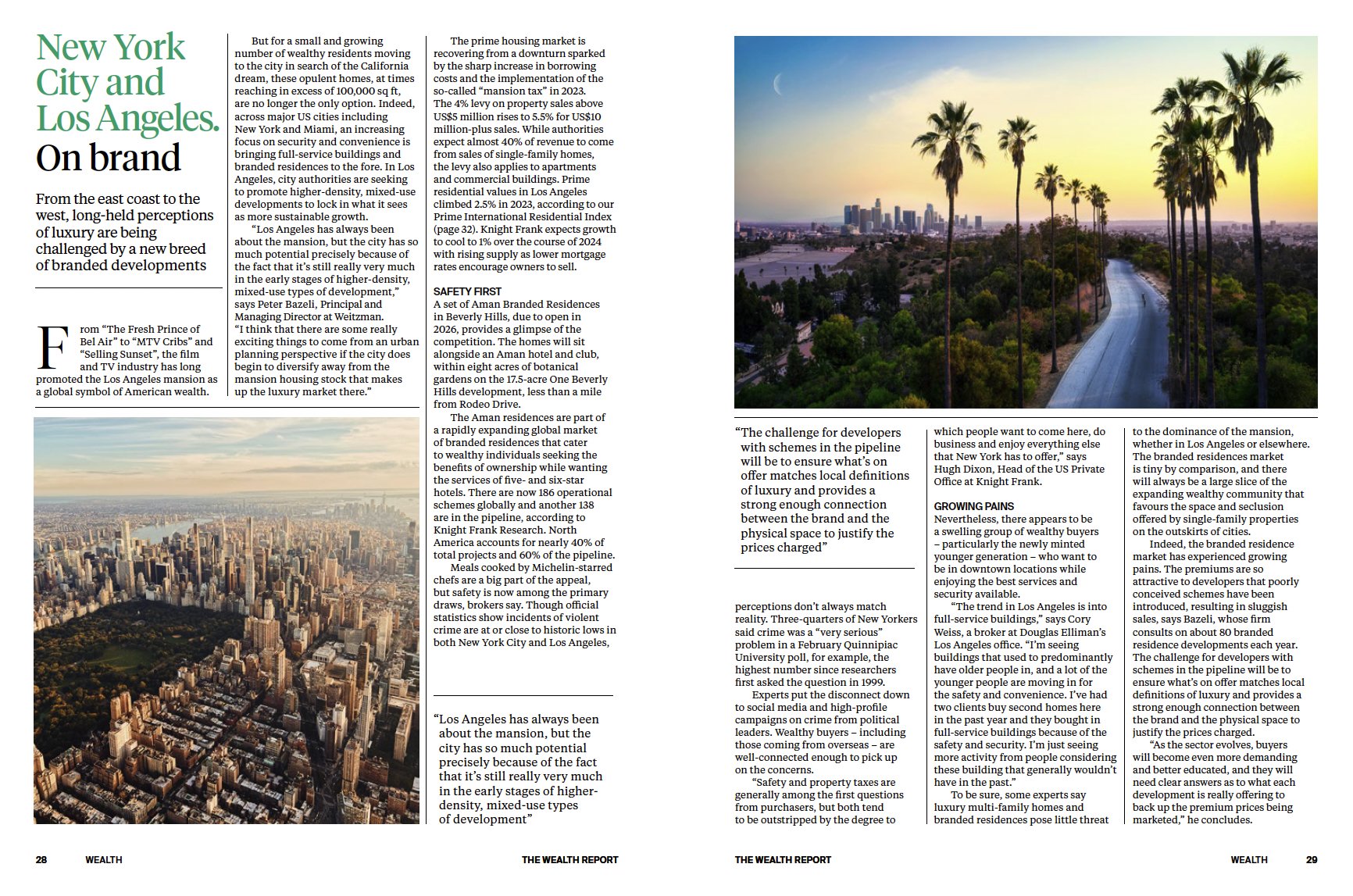

When the global property consultancy Knight Frank commissioned me to write a twelve-page report on the long-term prospects of nine of the world’s wealth hubs, it wasn’t clear to me that there would be an overraching theme. In fact, there were two.

This generation of the world’s wealthiest individuals is both better connected, and more mobile, than ever. Both themes are encapsulated by the Credit Suisse saga. In that particular case, wealthy individuals were primarily moving money, but the principle applies equally to physical movement, too.

From Miami to Milan, relative upstarts among the world’s wealth hubs are challenging the supremacy of incumbents such as New York and London. An increasingly nomadic group of wealthy families appear happy to respond to incentives to move, whether these span tax, safety, or simply a change of lifestyle.

Of course, Credit Suisse is just one bank, but at the time of writing Swiss regulators are questioning whether the banking system’s reliance on wealthy – and flighty – individuals poses as many risks as opportunities. It must be careful how it addresses the problem: for the world’s 1%, leaving has never been easier.

You can read the full report by downloading the Wealth Report 2024 from the Knight Frank website - the feature begins on page 18.

Kent Nordic provides a range of services to Knight Frank, spanning content strategy, writing, editing and media training. Looking for something similar? Get in touch.

- Patrick

The role:

Editorial consultancy

Content writing

Editing